The Defense Base Act (“DBA”) allows a claimant to shift liability for attorney’s fees to the employer and insurance carrier, if certain criteria are satisfied. In that context, sometimes fee disputes arise. In a fee dispute, the employer or insurance carrier argues that a claimant attorney’s hourly rate is excessive, or that certain time entries should not be paid. For the most part, this post does not address hourly rates. Instead, this post addresses the amount of time billed for particular tasks…and a proposed way for the Office of Administrative Law Judges (“OALJ”) or the Office of Workers’ Compensation Programs (“OWCP”) to avoid lengthy and often contentious fee litigation. Those agencies could adopt a fee procedure similar to Local Rule 54.3 from the Northern District of Illinois. How Local Rule 54.3 Helps: Sometimes, the attorneys hired by DBA carriers make hypocritical objections to time entries on a claimant attorney’s fee petition. ByRead more

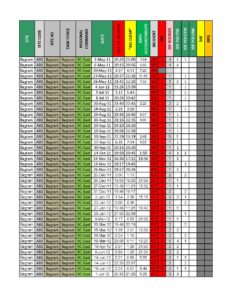

Let’s Talk About Attack Logs in Defense Base Act Claims…

Let’s talk about the use of attack logs in Defense Base Act claims. These incredibly helpful logs, which many contracting companies maintain in the regular course and scope of business, are directly relevant to the existence of working conditions which could have caused or contributed to a DBA claimant’s injury. Yet, some insurance carriers often try to hide this discoverable information. Some have even claimed that they “have no records of attacks relating to Claimant or Employer’s property” even though they have attack logs (and more) in their possession. That’s a lie. So, I am going take the mystery out of attack logs. I am going to explain what they are, why they are relevant, what insurance carriers use them for, how the Office of Administrative Law Judges have responded to motions to compel, and how it prejudices a claimant when an insurance carrier hides relevant information. Finally, I willRead more

Can a Carrier Compel a War Hazards Depo in an Undisputed DBA Claim?

Recently, a handful of defense attorneys have demanded a claimant’s War Hazards Compensation Act deposition while the case is still at the Office of Workers’ Compensation Programs. The cases are in pay status because the claimants became disabled after a work-related injury. There are no issues in dispute. Yet, the defense attorneys demand live, in-person depositions (sometimes in a foreign country). That begs the question: can an insurance carrier or its defense attorneys compel a claimant in a non-disputed case to participate in a deposition so that the carrier can get War Hazards Compensation Act facts? The Deposition’s Purpose: You may be wondering why an insurance carrier even wants a deposition in an undisputed claim. More likely than not, the desire is an offshoot of the mechanism of injury. When a Defense Base Act injury and disability is caused by a “war-risk hazard,” then the insurance carrier is entitled toRead more

Additional Thoughts on FECA Bulletin No. 18-03 and Psychological DBA Injuries

Last month, the Division of Federal Employees Compensation (“DFEC”) published FECA Bulletin No. 18-03. The bulletin addresses how the government agency will process an insurance carrier’s claims for reimbursement under the War Hazards Compensation Act (“WHCA”). Carriers apply for WHCA reimbursement after they pay a disabled contractor’s benefits pursuant to the Defense Base Act (“DBA”). FECA Bulletin No. 18-03 addresses psychological injuries, and the evidence that a carrier needs to submit to the government to receive reimbursement of the benefits it paid to the contractor. For some time now, insurance carriers have been concerned about the reception their evidence would receive at DFEC when applying for reimbursement. The concern was that the evidence they submitted would be too general or vague to warrant reimbursement. This concern trickled down into the underlying DBA claim, causing additional litigation for injured workers. With any luck, FECA Bulletin No. 18-03 will also trickle downRead more

FECA Bulletin No. 18-03 Offers Guidance on Psychological War Hazards Claims

A new FECA Bulletin answered a pressing question in the Defense Base Act and War Hazards Compensation Act community: what evidence is needed to prove emotional distress reimbursement claims? FECA Bulletin No. 18-03, which the Division of Federal Employees’ Compensation (“DFEC”) issued on June 6, 2018, is as useful in Defense Base Act claims as it is in War Hazards claims. There’s no denying that insurance carrier’s litigate DBA claims with an eye towards War Hazards reimbursement. The Defense Base Act and the War Hazards Compensation Act: Insurance carriers pay benefits to claimants pursuant to the DBA. Then, if the claimant’s injury was caused by a “war-risk hazard,” the carrier asks the U.S. government to reimburse the DBA benefits paid to the claimant. In other words, claimants are paid under the DBA. Carriers are paid under the War Hazards Compensation Act. To get reimbursement, the carrier must show that the claimant experienced aRead more

How Carriers Can Make Money By Losing Defense Base Act Claims

Today we’re going to run the numbers on a claim involving both DBA-only and DBA-WHCA injuries. By “DBA-only,” I mean that the claimant’s injury was not caused by a war event (like a rocket, mortar, or terrorist attack). And by “DBA-WHCA,” I mean that the claimant’s injury was caused by a war event. Knowing how to handle this type of case can result in massive savings for an insurance company and quicker benefits payment to an injured worker. The Defense Base Act Vs. The War Hazards Compensation Act: First, let’s discuss the Defense Base Act and its interplay with the War Hazards Compensation Act. The Defense Base Act is a system of federal workers’ compensation that applies to injured contractors working abroad. The DBA covers everything from slips-and-falls to the contraction of serious viruses to injuries caused by the actions of terrorists. The injured worker is compensated and receives medicalRead more

Bagram Plane Crash Caused By Error, Not Terrorists

Last year, on October 2, 2015, a cargo plane crashed in Afghanistan, killing 14 people. The dead included five military contractors. Recently, the United States Air Force determined that the crash was caused by the misuse of a night-vision goggles case. Essentially, the pilot used a night-vision goggles case to brace the plane’s yoke in a manner that made loading easier. As stated in the USAF Aircraft Accident Investigation report: The [mishap pilot] placed a hard-shell [night-vision goggles] NVG case forward of the yoke during the [Engine Running Onload/Offload (ERO) operations]. This placement of the case braced the yoke in a position that raised the elevator to facilitate off-loading high-profile (tall) cargo. The blocking of the flight controls during loading operations is a non-standard procedure; as such, there is no regulatory guidance to prohibit the act, or to address the proper placement and removal of the object blocking the controls.Read more

Who Can Diagnose Defense Base Act Medical Conditions?

Here’s a (surprisingly) not-so-simple question: who can diagnose medical conditions in Defense Base Act claims? Believe it or not, this question can throw a monkey wrench into the gears of an injured worker’s claim, particularly with psychological disorders. The rub is that, with psychological claims, the problem may actually stem from an unwritten and–as presented below–unwarranted application of law by the Division of Federal Employees Compensation (“DFEC”). Why DFEC? Because DFEC administers the War Hazards Compensation Act, the statutory scheme where the diagnosis logjam occurs most frequently. Interplay between the Defense Base Act and the War Hazards Compensation Act: Very generally, the Defense Base Act is a system of federal workers’ compensation that covers military contractors working overseas on military bases. When an employee is hurt, they file a claim for DBA benefits. Employers and insurance carriers are supposed to pay weekly compensation and medical benefits to employees with work-relatedRead more

Defense Base Act Death Claims After a Plane Crash

Last week, a C-130 aircraft crashed in Afghanistan, killing 6 airmen and 5 civilian contractors. Multiple media outlets reported on the crash. For instance, the Los Angeles Times wrote that the crash occurred Friday at Jalalabad Airfield in Afghanistan. Although a spokesman for the Taliban claimed that militants shot the plane down, those claims remain uncorroborated. This post addresses how a Defense Base Act proceeds when an aircraft accident occurs. The Defense Base Act: The Defense Base Act is a federal workers’ compensation system. It provides protection to contractors and subcontractors working overseas on a United States military base or working under a United States government contract. If a contractor is injured or killed, then the contractor or his loved ones may be entitled to benefits. As for the recent plane crash, any eligible surviving beneficiaries would be entitled to death benefits. When something like this happens, the contractors’ employers file a Form LS-202. This form isRead more

The War Hazards Compensation Act: A Primer

My new article is out. The Loyola Maritime Law Journal was nice enough to publish my piece, “The War Hazards Compensation Act: A Primer.” As soon as possible, I will update this post with a link to my SSRN page. There, you will be able to download a free copy of the article. In the meantime, here is the abstract: Over the past decade, the number of Defense Base Act and War Hazards Compensation Act claims dramatically increased. These two acts are inextricably intertwined when a “war-risk hazard” event causes an injured worker’s injury and disability. When that happens, an employer or its insurance carrier may use the War Hazards Compensation Act to secure reimbursement for Defense Base Act benefits and expenses paid on behalf of the worker’s injury and disability. Yet, little has been written to address the procedure for successfully maneuvering a claim from its Defense Base ActRead more

- 1

- 2

- 3

- 4

- Next Page »