Defense Base Act claims for foreign nationals are often resolved by settlement. The settlement is calculated by reference to the claim’s “commutation value.” Coronavirus has caused market changes and prompted interest rate cuts. As of March 4, 2020, the one year constant maturity rate was 0.59%, down from 1.98% just nine months earlier. Because “commutation value” is dependent on the interest rate, the recent market change has a huge effect on the Defense Base Act industry. The lower the one year constant maturity interest rate, the more expensive the “commutation value.”

Defense Base Act claims for foreign nationals are often resolved by settlement. The settlement is calculated by reference to the claim’s “commutation value.” Coronavirus has caused market changes and prompted interest rate cuts. As of March 4, 2020, the one year constant maturity rate was 0.59%, down from 1.98% just nine months earlier. Because “commutation value” is dependent on the interest rate, the recent market change has a huge effect on the Defense Base Act industry. The lower the one year constant maturity interest rate, the more expensive the “commutation value.”

As such, it might be necessary to reconsider outstanding settlement demands because the DBA claim’s value has likely changed.

What is Commutation?

In the Defense Base Act context, “commutation” is a remedy whereby insurance carriers can reduced their liability for indemnity benefits by one-half. The relevant statute, 42 U.S.C. 1652(b), states:

Compensation for permanent total or permanent partial disability under section 8(c)(21) of the [Longshore Act] . . . shall be in the same amount as provided for [United States] residents . . . except that the Secretary of Labor may, at his option or upon the application of the insurance carrier shall, commute all future installments of compensation to be paid to such aliens or non nationals of the United States by paying or causing to be paid to them one-half of the commuted amount of such future installments of compensation . . . .”

Commutation only applies after the claimant reaches maximum medical improvement. Also, it only applies to permanent total disability, unscheduled permanent partial disability, and death claims.

For this post, we are focusing only on unscheduled permanent partial disability because the vast majority of foreign national DBA claims fall in this camp.

Calculating Commutation Value:

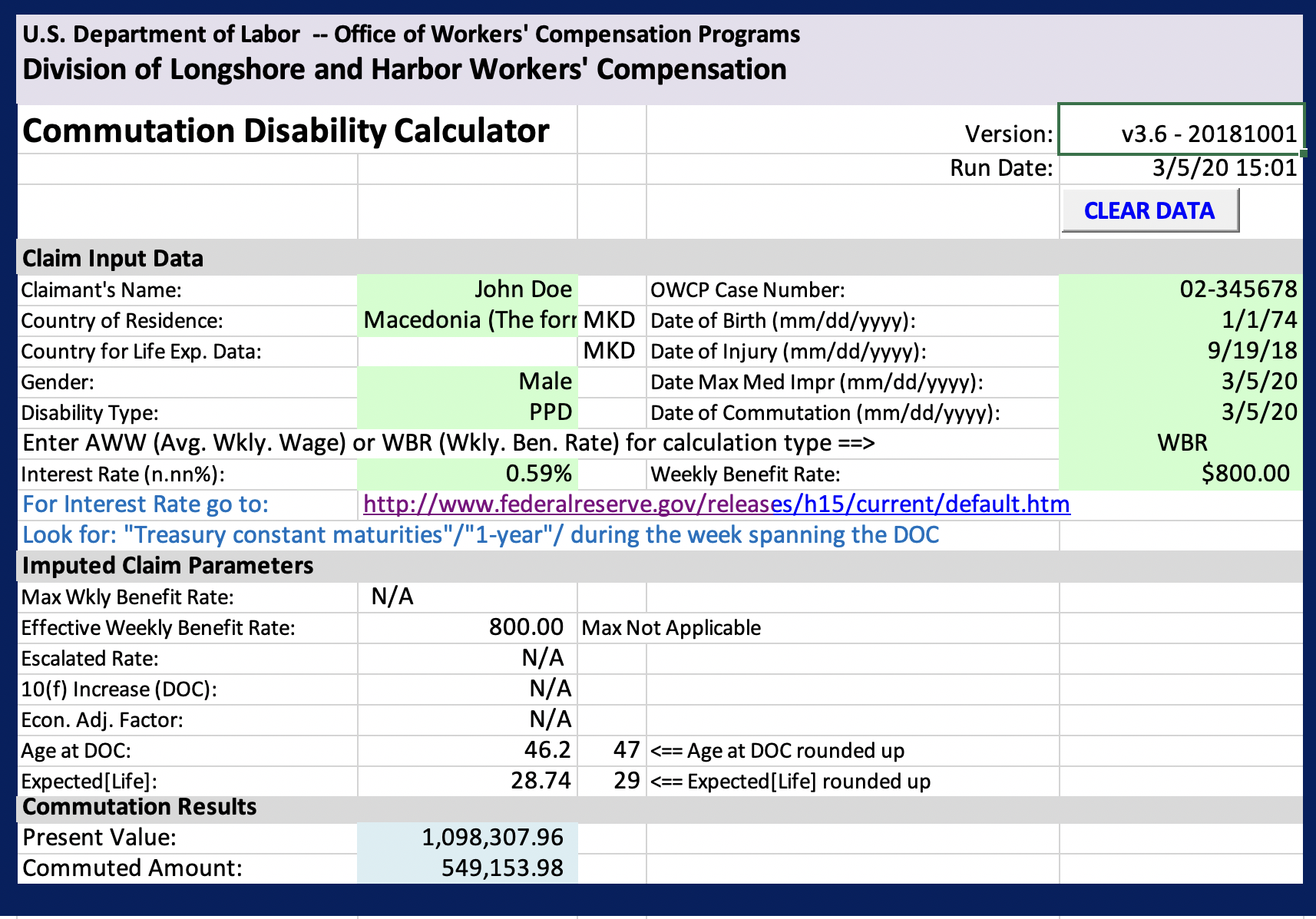

It’s actually pretty easy to calculate exposure value if you have a copy of the Department of Labor’s commutation calculator. The commutation calculator is an Excel spreadsheet. The user fills in claim-specific information, applies an interest rate, and then the calculator provides the commutation sum.

The necessary information includes:

- The claimant’s name

- OWCP case number

- Country of residence (to establish life expectancy)

- Date of birth

- Date of injury

- Gender

- Date of maximum medical improvement

- Disability type (permanent partial vs. permanent total)

- Date of commutation calculation

- Weekly benefit rate

- Interest rate for a one year constant maturity

The Importance of Interest Rates:

The interest rate that must be applied to the commutation calculation is the one year constant maturity rate for the date when the commutation is calculated. Interest rates change daily. The Department of Labor’s commutation calculator provides a link to the Federal Rerserve help the user find the most recent maturity rate.

For this post, I want to focus on the interest rate for a one year constant maturity on three specific dates: July 5, 2019, February 6, 2020, and March 4, 2020.

On July 5, 2019, the one year constant maturity interest rate was 1.98%.

On February 26, 2020, the one year constant maturity interest rate was 1.26%.

On March 4, 2020, the one year constant maturity interest rate was 0.59%.

Next, I want to apply those interest rates to a hypothetical claimant, John Doe. Mr. Doe’s weekly compensation rate is $800.00. He has a 29-year life expectancy. How does the change in interest rates affect Mr. Doe?

As of July 5, 2019, when the interest rate was 1.98%, the commutation value of Mr. Doe’s claim was $457,090.60.

Later, on February 26, 2020–after coronavirus had affected the market–the one year constant maturity rate fell to 1.26%. The commutation value of Mr. Doe’s claim rose to $501,719.14.

Finally, as of March 4, 2020, when the interest rate fell to 0.59%, the commutation value of Mr. Doe’s claim became $549,153.98. Mr. Doe’s commutation value is $92,063.38 higher than it was nine months ago simply because of the decrease in the applicable interest rate.

Conclusion:

The lower the interest rate, the higher the commutation value. The value of foreign national claims may have increased sharply over the last nine months. This passage of time is very important because some insurance carriers (or their attorneys) ignore settlement demands for months on end–even when they requested the demand.

A settlement demand that was current when it was given may not be current now because of changes in the one year constant maturity interest rate. Consult your attorney to determine whether a prior settlement demand should be retracted in favor of an up-to-date settlement demand.

On one final note, it will be interesting to see how the Department of Labor and the Office of Administrative Law Judges responds to the increased commutation value. At the end of the day, the government must assure that a settlement is monetarily “reasonable.”

Finally, for frame of reference, here is a screenshot of a completed commutation using the Department of Labor’s commutation calculator. This screen shot shows the commutation value of a foreign national claimant with an $800 weekly compensation rate and a 29-year life expectancy–our John Doe mentioned above.