This is the final installment of my Defense Base Act Industry Report Card series. So far, we have looked at the reporting and payment percentages for ACE, AIG, AWAC, and CNA. Today, I will focus on Zurich, the Division of Longshore and Harbor Workers’ (“DLHWC”) reporting and payment goals, and how the DBA insurance carrier measures up against the DLHWC goals.

This is the final installment of my Defense Base Act Industry Report Card series. So far, we have looked at the reporting and payment percentages for ACE, AIG, AWAC, and CNA. Today, I will focus on Zurich, the Division of Longshore and Harbor Workers’ (“DLHWC”) reporting and payment goals, and how the DBA insurance carrier measures up against the DLHWC goals.

To recap, the DLHWC creates “report cards” for the large insurance carriers offering Defense Base Act insurance. The DLHWC focuses on timeliness of reporting the injury and timeliness of paying benefits. Each insurance carrier voluntarily provides its reporting and payment percentages to the DLHWC, which publishes the information on its website. My series of posts takes the same information and plugs it into carrier-specific line graphs. In my opinion, the line graphs make it easier to chart each carrier’s performance–and whether performance is declining.

Zurich:

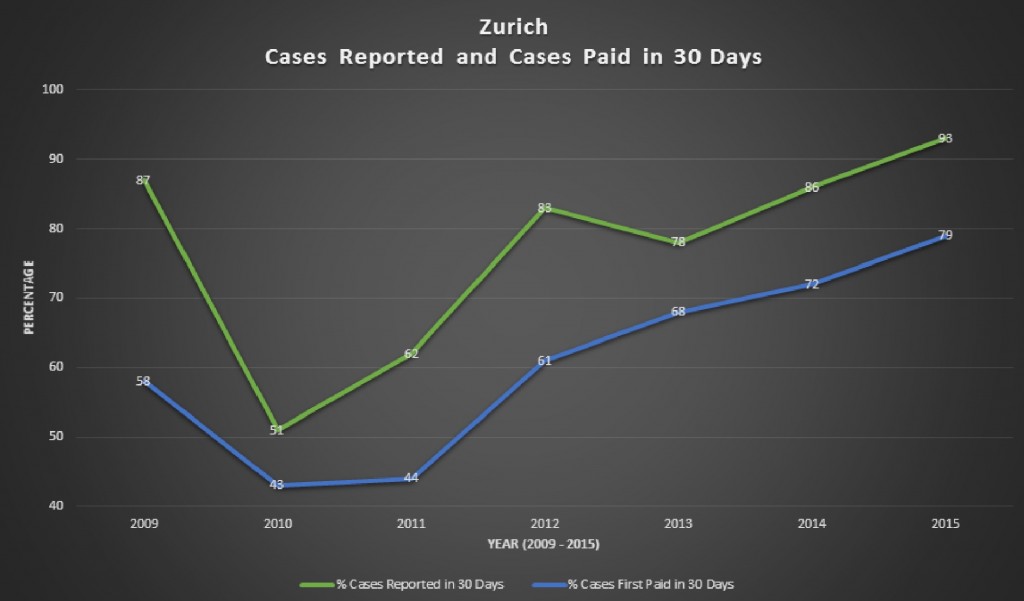

Overall, Zurich’s self-reported data shows a company on the upswing. Although 2010 and 2011 demonstrate low percentages for reporting and paying within 30 days, the 2015 data demonstrates a drastic improvement in both categories.

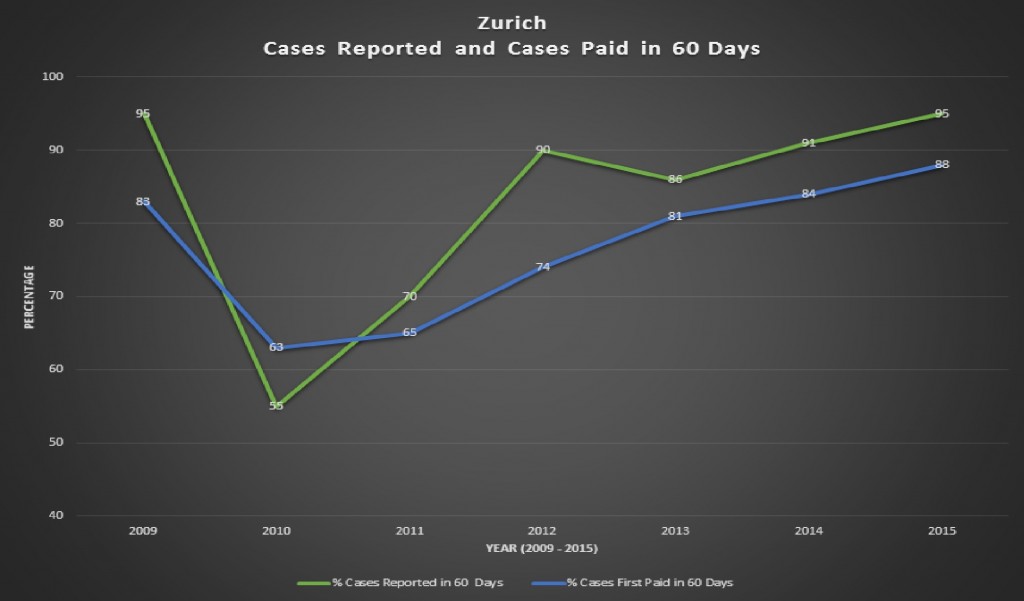

The 60-day graph shows an interesting anomaly–as does the 90-day graph. There were more cases paid within the 60-day window than there were cases reported. Still, though, Zurich’s 2015 numbers are much better than their 2010-2011 numbers. Moreover, the payment percentages increased by at least 9% between the 30- and 60-day windows, which show that cases are being worked and moved forward.

The 60-day graph shows an interesting anomaly–as does the 90-day graph. There were more cases paid within the 60-day window than there were cases reported. Still, though, Zurich’s 2015 numbers are much better than their 2010-2011 numbers. Moreover, the payment percentages increased by at least 9% between the 30- and 60-day windows, which show that cases are being worked and moved forward.

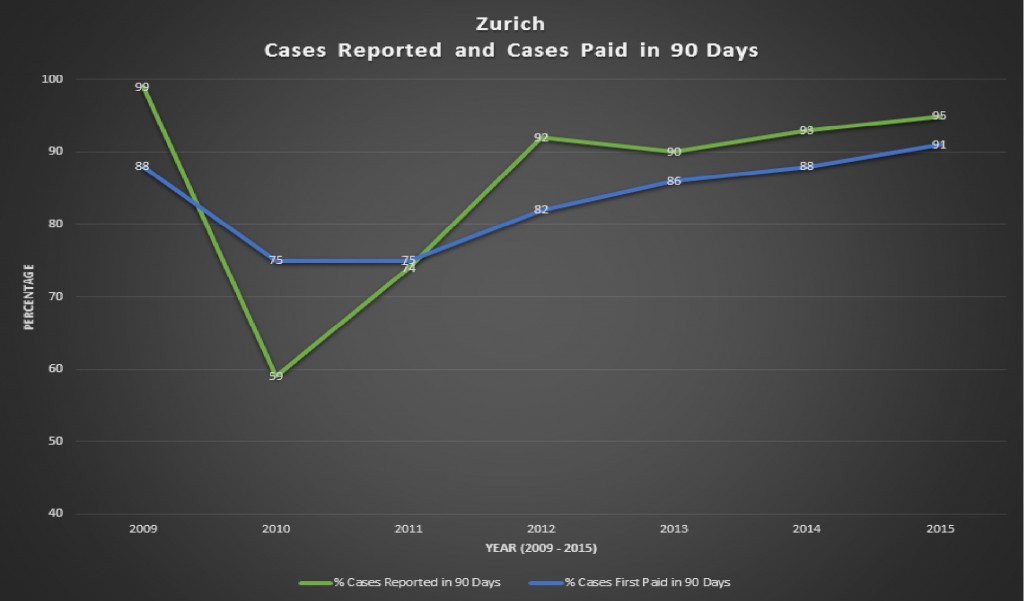

The 90-day graph shows the same reporting vs. payment anomaly in 2010. For what it’s worth, I’m giving Zurich a mulligan for 2010. At least the payment percentage was 75% within 90 days. The remaining years demonstrate a positive increase, to the point that by 2015 there was a 91% payment percentage. The rub, though, is that the payment percentages in the past few years increased only slightly between the 60- and 90-day windows. That might mean that a controverted (i.e., denied) case remains controverted if not paid within 60 days.

The 90-day graph shows the same reporting vs. payment anomaly in 2010. For what it’s worth, I’m giving Zurich a mulligan for 2010. At least the payment percentage was 75% within 90 days. The remaining years demonstrate a positive increase, to the point that by 2015 there was a 91% payment percentage. The rub, though, is that the payment percentages in the past few years increased only slightly between the 60- and 90-day windows. That might mean that a controverted (i.e., denied) case remains controverted if not paid within 60 days.

Starr Indemnity:

Note that I have not prepared a line graph for Starr Indemnity. Starr is a new player in the DBA industry. It has not been around long enough to provide data for a line graph. Nonetheless, it should be noted that Starr’s reporting and payment percentages are much higher than the other carriers. The 2015 percentages for Starr show that 93% of cases were reported and 94% of cases were paid within 30 days. Kudos.

The Government’s Goals Versus Carrier Efficiency:

The DLHWC has set goals for reporting and payment percentages–but only for the first 30 days. The performance chart, which can be found here, shows that the DLHWC expects an increase in reporting and payment efficiency. And, according to the DLHWC, the performance goals have been met.

But there’s a catch, the DLHWC’s published performance goals take all Defense Base Act claims into account. The results are not carrier-specific. Still, the numbers are important. For 2015, the DLHWC wanted 85% of DBA cases reported within 30 days. It says that reporting percentages equaled 91%. Further, for 2015, the DLHWC wanted 65% of cases paid within 30 days. The result: 67%.

Still, though, how does each carrier measure up? Do the DLHWC’s reporting and payment percentages really show an industry-wide increase in efficiency, or are some carriers paying while other carriers are not?

To answer that question, look at the line graphs in parts 1 and 2 of my DBA Industry Report Card series, or at the table created by the DLHWC and published on its website. Although all DBA carriers satisfied the DLHWC’s 85% reporting goal, only three carriers satisfied the 30-day payment goal of 65%. Payments during the first 30 days of a claim, per insurer, break down as follows: ACE (59%), AIG (58%), AWAC (61%), CNA (73%), Starr Indemnity (94%), and Zurich (79%). These results beg the question: when looking at overall performance, are CNA, Starr and Zurich’s payment percentages propping up ACE, AIG and AWAC?

Moreover, why should performance goals stop at 30 days? The DLHWC should set goals for the 60-day and 90-day time periods, too. Most carriers can demonstrate a positive increase in the number of payments made within 90 days. All the same, there are some dips and drops in payment percentages which merit investigation. For instance, ACE’s payment percentages for 60-day cases fell from 81% in 2015 to 74% in 2015; and for 90-day cases, ACE fell from 90% in 2014 to 77% in 2015. Many carriers showed positive growth in payment percentages for 60- and 90-day cases in 2015. At the very least, if there wasn’t positive growth, the decline in 90-day payment percentages was small. Whereas CNA dipped 2% and AWAC dipped 3% 2015, ACE fell 13%. Such a high percentage in controverted claims as compared to earlier years may demonstrate a fundamental change in claims handling. The drop certainly raises eyebrows.

It would also be nice to know what type of Defense Base Act cases are being denied. When an injured worker files a claim or an employer reports an injury, the type of injury must be reported. I would like to know what types of injuries are most often denied. Are carriers denying slip-and-fall injuries? Or psychological injuries? Based on my experience, carriers are more quick to question and deny psychological injuries than anything else–which is a shame considering the need for quick mental health treatment to prevent worsening of the psychological condition.

Conclusion:

The DLHWC performance goal and report card webpages offer interesting insight into the payment of Defense Base Act claims. Reducing that information to line graph formal provides an excellent visual representation of the highs and lows of each carrier’s claims handling process. I invite you to go back and look at the first and second posts in the DBA Industry Report Card series to compare and contrast the reporting and payment percentages.

Attribution: Photo courtesy of Flickr user dingler1109 (nolarisingproject).