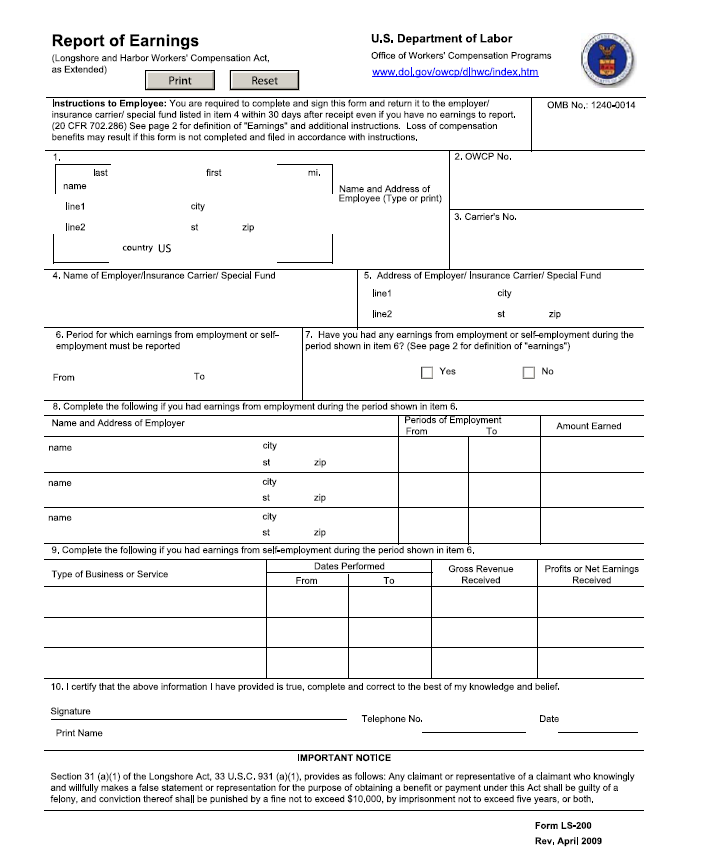

Recently, I received a request that one of my clients complete the Report of Earnings, Form LS-200. This is a form developed by the Department of Labor’s Division of Longshore and Harbor Workers’ Compensation. The form itself is completely legit. But, in my case there was a problem. The employer and carrier were not paying compensation to my client. Consequently, the issue was whether my client may refuse to complete the requested form because the employer and carrier were not paying Defense Base Act benefits.

Recently, I received a request that one of my clients complete the Report of Earnings, Form LS-200. This is a form developed by the Department of Labor’s Division of Longshore and Harbor Workers’ Compensation. The form itself is completely legit. But, in my case there was a problem. The employer and carrier were not paying compensation to my client. Consequently, the issue was whether my client may refuse to complete the requested form because the employer and carrier were not paying Defense Base Act benefits.

Statutory Basis for the Report of Earnings:

The Defense Base Act is an extension of the Longshore and Harbor Workers’ Compensation Act (“LHWCA”). Section 8(j) of the LHWCA contains the provision for reporting earnings. See 33 U.S.C. § 908(j). It states:

(j)(1) The employer may inform a disabled employee of his obligation to report to the employer not less than semiannually any earnings from employment or self-employment, on such forms as the Secretary shall specify in regulations

(2) An employee who–

(A) fails to report the employee’s earnings under paragraph (1) when requested, or

(B) knowingly and willfully omits or understates any part of such earnings,

and who is determined by the [district director] to have violated clause (A) or (B) of this paragraph, forfeits his right to compensation with respect to any period during which the employee was required to file such report.

Let’s look a little closer at that language. Failing to report earnings could result in a forfeit of the injured worker’s right to compensation. That is a pretty big penalty. But there is a catch: the employee must be “required to file such report.” See 33 U.S.C. § 908(j).

A Regulation Answers the Question:

Even though the United States Code provides the means for requesting post-injury earnings, it does not give employers and carriers unbridled access to this information. As explained in the Code of Federal Regulations, an employer and carrier may not demand an injured worker to complete the Report of Earnings, Form LS-200, unless the employer and carrier are paying compensation. Specifically, 20 C.F.R. § 702.285(a) says (with emphasis added):

An employer, carrier or the Director (for those cases being paid from the Special fund) may require an employee to whom it is paying compensation to submit a report on earnings from employment or self-employment. This report may not be required any more frequently than semi-annually. The report shall be made on a form prescribed by the Director and shall include all earnings from employment and self-employment and the periods for which the earnings apply. The employee must return the complete report on earnings even where he or she has no earnings to report.

The regulation is clear: an employer and carrier may demand a report of earnings only when they are paying compensation to the employee. This reading of 20 C.F.R. § 702.285 comports with interpreting caselaw. See, e.g., Delaware River Stevedores v. DiFidelto, 440 F.3d 615, 622 (2006) (reasoning that a claimant is not obliged to respond to an employer’s request for a report of earnings when the employer was not paying compensation); Briskie v. Weeks Marine Inc., 38 BRBS 61 (2004) (holding that a claimant is not legally obligated to comply with a request for a Form LS-200 when the employer was not paying compensation to the claimant at the time it made the Form LS-200 request).

Conclusion:

The penalty for failing to report earnings, when asked, could be the forfeiture of benefits. Accordingly, any request for post-injury earnings must be taken very seriously. If the employer and carrier are paying compensation, then the claimant has to fill out the form. All the same, when the employer and carrier are not paying compensation, they cannot demand that a claimant provide them with a completed Report of Earnings, Form LS-200 (pictured below). There’s no need to threaten a penalty like the forfeiture of compensation payments when compensation is not being paid in the first place.

Invitation: If you are having an issue in your Longshore or Defense Base Act claim, contact Jon Robinson at (844) 322-2667 or [email protected] for a free case evaluation and consultation.

Attribution: Photo courtesy of Flickr user 401(k) 2012.